Artificial intelligence is transforming cryptocurrency markets. AI-powered trading bots now analyze massive amounts of data, detect patterns, and execute trades faster than human traders. These advanced systems are revolutionizing the way digital assets are managed and invested.

Crypto investors are turning to AI-driven strategies to reduce risks and maximize gains. Platforms like Multisyntrix showcase how automation is making trading more accessible and efficient. AI models use historical data, market trends, and predictive analytics to make smarter investment decisions.

How AI Enhances Crypto Trading

AI-driven crypto trading operates by processing large datasets, identifying profitable opportunities, and executing trades with minimal human intervention. Some key advantages of AI in crypto trading include:

Market Analysis and Prediction

AI algorithms analyze historical price movements, sentiment from news sources, and blockchain data to predict future trends. Machine learning models continuously refine their accuracy, improving decision-making over time. This allows traders to anticipate market fluctuations and make informed decisions before price swings occur.

Automated Trading Strategies

AI trading bots execute orders based on pre-set strategies, eliminating emotional bias. These systems can perform arbitrage, trend following, and high-frequency trading at speeds impossible for humans. By automating trades, investors can exploit profitable opportunities without constantly monitoring the market.

Risk Management and Portfolio Optimization

AI assesses market volatility and adjusts portfolio allocations accordingly. This minimizes losses and enhances overall portfolio performance by balancing risk and reward. Advanced AI models can analyze multiple factors simultaneously, including liquidity, order book depth, and global economic trends, to create a diversified investment strategy.

Case Studies of AI-Powered Crypto Platforms

Several AI-powered platforms have emerged recently, offering traders various automated trading solutions. Below are some of the most notable ones:

1. CryptoHawk

CryptoHawk is an AI-powered trading platform that uses deep learning to identify high-probability trades. It analyzes real-time data and provides automated trading strategies tailored to user preferences. The platform’s predictive analytics have helped traders generate consistent profits by reducing reliance on human intuition.

2. Bitsgap

Bitsgap integrates AI with grid trading, enabling traders to capitalize on market fluctuations. The platform automates buy and sell orders, ensuring profitability even in volatile conditions. Traders can set stop-loss and take-profit orders to protect their investments while benefiting from AI-driven decision-making.

3. 3Commas

3Commas offers AI-driven trading bots that help users manage crypto portfolios across multiple exchanges. Its smart trade features include stop-loss and take-profit settings, reducing risk while maximizing gains. The platform also provides social trading capabilities, allowing users to follow and copy successful traders’ strategies.

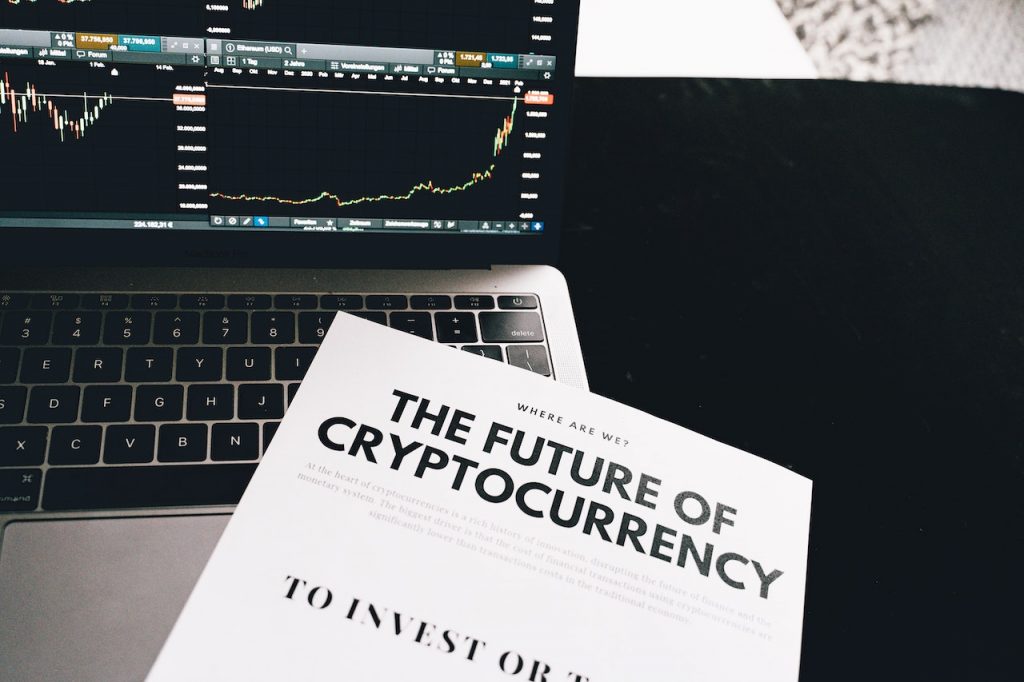

The Future of AI in Cryptocurrency Markets

The future of AI in crypto looks promising. As machine learning models become more sophisticated, trading bots will continue to refine their accuracy. Emerging technologies like quantum computing could further enhance predictive analytics, allowing AI systems to process complex calculations at unprecedented speeds.

Regulation will also play a crucial role. Governments and financial institutions are exploring ways to ensure AI-driven crypto trading remains transparent and secure. With proper oversight, AI will continue shaping the digital asset market, making it more efficient and accessible.

The Role of AI in Decentralized Finance (DeFi)

Decentralized finance (DeFi) is another area where AI is making an impact. Smart contracts powered by AI-driven decision-making allow users to engage in lending, borrowing, and yield farming without intermediaries. AI can analyze user behavior and market conditions to optimize liquidity pools, interest rates, and asset allocation.

Ethical Considerations and Challenges

Despite the benefits, AI-driven crypto trading comes with challenges. The reliance on AI introduces risks such as system failures, flash crashes, and data manipulation. Ethical concerns also arise regarding the potential for AI to create unfair advantages for institutional traders over retail investors.

To mitigate these risks, developers must ensure transparency in AI algorithms and provide safeguards against market manipulation. Collaboration between regulatory bodies and tech innovators will be essential to maintain a fair trading environment.

READ ALSO: Explore the Potential and Risks of Investing in Digital Currencies

Conclusion

AI-powered automation is revolutionizing cryptocurrency trading. From predictive analytics to real-time portfolio optimization, these technologies provide traders with better insights and faster execution. As AI evolves, it will unlock new opportunities, ensuring a more efficient and profitable digital asset ecosystem.

The future of digital assets will be shaped by AI’s ability to process complex data, manage risks, and execute trades precisely. While challenges remain, AI-driven automation is poised to redefine how investors interact with cryptocurrency markets.